Watch Out For These 10 Common Internet Scams in 2025

Quick Answer: Avoid common internet scams

The best way to stay safe from scams is to apply common sense. If something feels off to you, it probably is. NordVPN’s Threat Protection Pro can help you detect domains associated with scams.

Try it for free with a 30-day money-back guarantee.

Day by day, the number of internet scams is growing. As of August 2020, 47% of global internet users have noted a significant increase in cyber fraud and online scams. Another 60% expect this strong wave of online scams to continue into the next year. So much for a safe start to the new year, am I right?

In 2020, Americans lost more than $4.2 billion due to internet crime, but financial losses aren’t the only thing to worry about. Learn more in the scams statistics and facts guide.

- Best for scam protection

The shift to online life during the pandemic means most of us are spending a lot of time on our social media feeds. The bad news: your feeds aren’t a safe space either, with social media scams accounting for 23.6% of phishing attacks in the first quarter of this year.

Internet crime complaints grow day by day. There are a number of common online scams that internet users fall victim to on a routine basis because they don’t see the warning signs. Keep reading to find out what the top scams are and how you keep your online activity safe.

What are the most common internet scams?

Some of the most common online scams are phishing email scams, malicious software hacks, get-rich schemes, tech support scammers and fake shopping websites.How can you tell an internet scammer?

If someone you don’t know contacts you out of the blue with suspicious demands and requests, it’s a red flag. This includes asking for payment information, access to your computer or personal details.

How do online scams work?

Online scammers often make fake promises, offering something that sounds too good to be true. They prey on your innocence and willingness to help or “win something” in exchange for information.What happens if I get scammed?

If you’re a victim of a scam, report the fraud to the authorities, including your local police, your state consumer protection office and the FTC. You can also contact additional agencies for support.

Top Internet Scams 2021

- Fake antivirus scams

- Online job scams

- Phishing scams

- Fake shopping websites

- Advance fee schemes

- Credit card scams

- Natural disaster relief scams

- Romance scams

- Grandparent scams

- IRS scams

The 10 Most Common Online Scams

We spend a fair share of time on the internet, so it’s only fair to also see the dark side of it and keep ourselves ready from being made victims of an online scam.

1. Fake Antivirus Scams

Imagine this: You open your laptop to a new day of gaming and internet fun only to have it glitch out on you. Badly. You start Googling for solutions and see ads pop up that convince you of the worst possible scenario that your system is riddled with viruses. The good news is you can download free antivirus software to fix it! That’s what they want you to think.

Scammers like taking advantage of unsuspecting victims by creating free and fake antivirus software to “help” you. Your computer might actually have a virus or just some hardware issues, but in your rush to fix it, you end up falling prey to fake antivirus software and installing “scareware.” This is a “from the pan, to the fire” scenario.

By installing scareware, you let scammers claim access to your computer and sensitive information. This could include personal information such as your credit card details and financials, even leading to identity theft in extreme cases.

Did you know that 92% of malware is delivered by email? Vade Secure, an email security firm, uncovered online scammers posing as tech-support to claim remote access to users’ computers by using fake antivirus renewal invoices. There’s no limit to the creativity such scammers can use.

What to Look Out For

Have an authentic paid antivirus subscription on your devices. Don’t be a Bob from Schitt’s Creek and believe it when a scammer says, “you’ll know the software is working if you don’t see any changes!”

Keep an eye out for strange pop-ups, and don’t fall for enticing subject lines that want you to take urgent action. It’s also wise to consult with actual IT experts before jumping the gun.

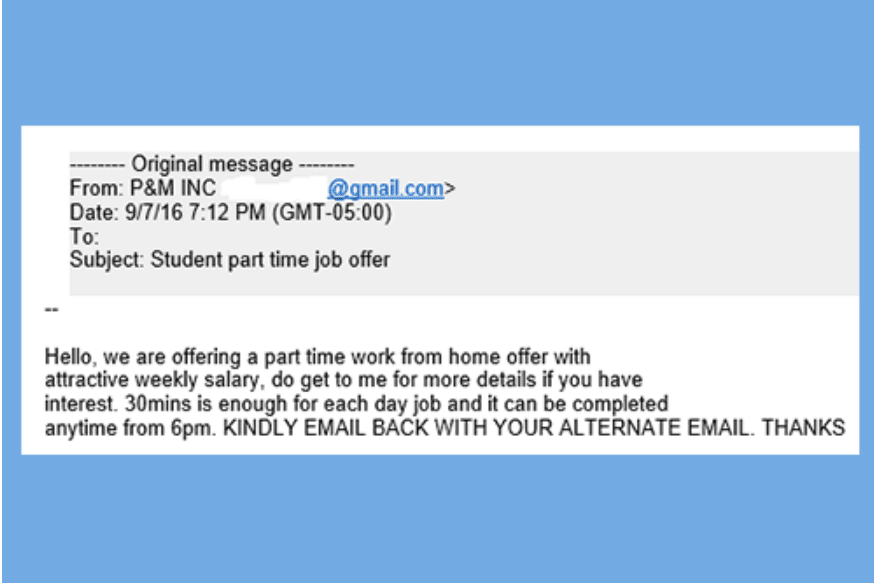

2. Online Job Scams

The pandemic has been harder financially on some people than on others. Such individuals might be on a job hunt. Unfortunately, online job scams are on the rise too. Scammers pose as recruiters or employers, motivating you to apply with a tempting salary by boosting your ego and saying your skills are the perfect fit.

Reports have shown that fraudulent job agencies and online scammers have grown since the pandemic, with business opportunities and work-at-home plans being the highest reported frauds to the Federal Trade Commission.

Don’t fall for it blindly. The company or recruiter might not even exist and is simply baiting you into submitting an “application” designed to steal your personal information.

In other cases, they might employ you for small jobs where you unwittingly become an accomplice to a crime like laundering stolen goods by making bookings on their behalf or conducting reshippings.

Other online job scams aren’t as sophisticated and straight-up demand an “application fee” for a very rewarding job. You might be tempted to pay it if the job looks promising. Be wary of the URLs shared as well as they might be fake with subtle changes in the name to a well-known company, for example, “star-bucks.com” instead of “starbucks.com”.

What to Look Out For

Just as you would do your research for a job interview, you should be just as thorough and verify the authenticity of the actual job and recruiter. Look up the point of contact on LinkedIn and see if they have a lot of engagement within their network.

You can also Google the company, see how many followers they have and whether any reviews have been posted on Google My Business.

3. Email Phishing Scams

You open your inbox and see an email from a familiar name. It could be your internet service provider, your bank or maybe a retailer you shop with regularly. The message asks you to verify your contact information or bank account information as part of a “check” or something similar. Sounds fishy, right? You’d be surprised how many people fall prey to this email scam.

FBI reports indicate that phishing was the most prevalent cybercrime reported in 2020, nearly doubling in frequency since 2016. When it came to phishing attacks against organizations, 74% of them were successful. Learn more in the phishing statistics guide.

The FTC says most phishing attacks come through email and text messages by tricking people into opening attachments or links. The bait may include them saying they’ve noticed suspicious activity in your account, say you’re eligible for a refund or special offer, offer free goods or even include a fake invoice.

Cybercriminals also attempt to target companies, not just individuals. Recently, the U.S. trading platform Robinhood Markets faced a phishing attack where a customer support agent fell prey to a trick, and more than 300 customers’ personal details were exposed to the scammers. Check out my article on phishing scams for more information.

What to Look Out For

Be attentive to the details of the communication you’re receiving. Verify the email and see if it’s from the actual company you know. Don’t click on any links from emails if you can’t confirm their authenticity. Phishing emails often include subtle typos or suspicious fake emails.

Also keep in mind, no legitimate company would explicitly ask for your password or personal information online.

4. Fake Shopping Websites

It’s no surprise that with COVID doing a world tour right now, online shopping has been booming. Instead of hitting up the local GAP on every block, people have flocked to online shopping sites for their purchases. In fact, 67% of consumers have changed the way they shop.

Unfortunately, that makes us more susceptible to shopping scams. The jump in online sales enables scammers to trick eager consumers into buying from brands they believe are luxury providers, but instead receive low-quality goods in exchange. In some cases, people receive nothing at all.

Some malicious websites even put up a front as an online store to trick consumers into shopping online, just so they can steal their financial information and personal records during the checkout period. Identity theft is also possible in such cases.

These online shopping scams are also growing on social media, namely Facebook, where “brands” promote a fake store on their social media page or user feeds. After clicking on the link to shop or “buy now,” you get taken to malicious sites instead that have every intention to scam you.

What to Look Out For

Double-check the URLs of these sites and see if they differ from the original brand they’re claiming to be. For example, tomf0rd.com instead of tomford.com. It’s subtle, but if you pay close enough attention, you’ll catch it before the scammer gets a chance to rob you blind.

You should also double-check the payment page URLs of authentic shopping sites. Sometimes, legitimate shopping websites get hacked, and shoppers get redirected to a malicious payment page, as I mentioned before. To avoid this, just make sure the URL on the payment page matches the real company’s name.

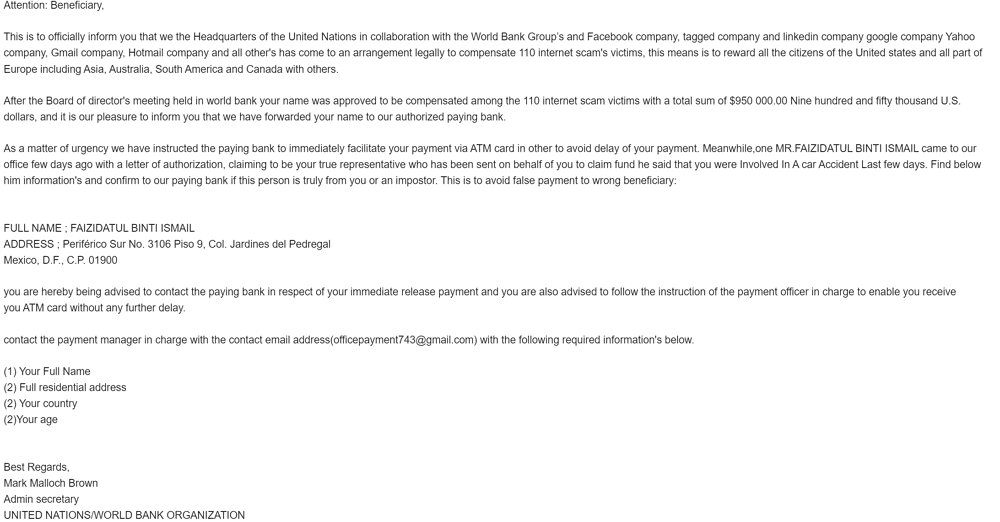

5. Advance Fee Scheme

An advance-fee scheme is one of the most common scams on the internet. There are many classic iterations of this scam, such as the Nigerian prince scam where you’re asked to transfer a large sum of money to a fake, royal figure or even the Jamaican lottery scam where you’re tricked into providing your financial information in exchange for a huge payout.

But guess what? It’s not your lucky day.

Most of these scams may have legitimate messages attached to them that sound every bit convincing. Some scammers promise financing arrangements with the request for a “finder’s fee” payment, and after such payment is made, the person totally disappears and defrauds the victim.

Other smart cons involve posing as a U.S. broker or agent who helps investors recover stock market losses but requests an upfront fee or security deposit. Trick’s on you, bud — you’ll only end up with an even bigger loss.

You don’t want to be out $1.2 million for trusting the wrong person online. True story, folks.

What to Look Out For

Does the offer sound too good to be true? Then it probably is. Trust your gut. If it feels like a scam, don’t engage.

If you do choose to engage, make sure you do your research on the point of contact and verify they actually exist. You can check with the Better Business Bureau and even run any contract by your lawyer to verify there are no loopholes meant to scam you, like a suspicious NDA.

6. Credit Card Scams

Admit it: we all hate paying interest. Be it on our loans, mortgage and especially our trusty credit cards. So if someone comes to you with the offer of helping lower your interest rates, you might want to believe them and end up giving your credit card details. That’s exactly how you’ll end up losing money, and in some cases, even your identity.

The data breach dilemma is very common in the credit and debit card universe. Several scammers steal the personal information of individuals to access their credit reports and gain access to your funds. Others might take your personal information just to open credit cards in your name and scam the credit card companies themselves by pretending to be you.

This happened recently, with a scammer going so far as to pay USPS carriers to steal credit cards as part of an identity theft scam. Over $750,000 were scammed and spent on buying luxury goods, with the actual victims none the wiser.

What to Look Out For

Be on the lookout for suspicious offers and safeguard all your credit card information. If you notice anything suspicious in your account activity, raise a red flag with your credit card company. It’s always important to report scams the moment you’re aware of them.

You can also sign up and enroll in free consumer protection services and sign up for free credit monitoring services.

7. Natural Disaster Relief Scams

Natural disasters are terrible and can lead to the loss and total uprooting of several lives. Some scammers prey on the good nature of people who wish to donate to relief centers and NGOs by posing as fake websites and charities, only to take the donations for themselves.

According to the National Center for Disaster Fraud, the most common disaster-related scams reported include scammers impersonating law enforcement officials and fake solicitations for charity donations. Such scammers often create fake charities with names very similar to trusted and popular organizations.

Just this year, $1.2 billion has been lost to charity fraud. Scammers get even more excited during Christmas, when they may show up to your door and ask for donations for fake causes. A woman in Maryland donated $40, believing it would be for disabled veterans.

What to Look Out For

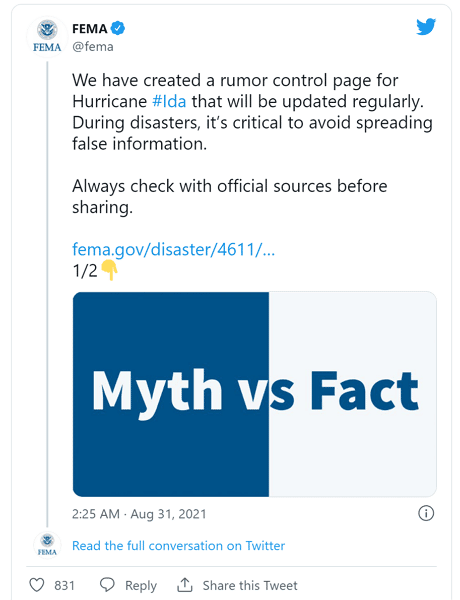

If you get phone calls from a “charity” requesting for your personal information, don’t engage. Instead, make sure you do your research on the authenticity of the charity and then contact that charity independently.

You can check directly with the sources, such as government agencies like FEMA. Their rumor control page and website provides accurate information to avoid miscommunication and report any scams that may be happening in your local area, through charities or otherwise.

8. Romance Scams

We all love a good romance… until you end up both loveless and penniless.

In online romance scams and internet dating scams, the scammer sways and tickles your romantic feelings and tricks you into providing your personal information or even giving them money. Then they rob your bank account and identity — not just your heart!

In 2019, U.S. citizens lost $143 million to romance scams. It’s easy to think you won’t fall for this, but the power of trust in the wrong person is great. Scammers know this.

What to Look Out For

The best way to avoid this is never to give money to someone online that you haven’t met before unless you can verify their actual existence and intentions.

Such scammers will also promise to come see you in person, but continually go back on their word. You may just chalk this up to “commitment issues,” “shyness” or something else, but it’s a red flag for sure.

Do a deep dive into your potential lover’s social media and stick to your gut. If they’re asking for your personal information two days into talking, that’s obviously a no-go. Don’t be that person who lost almost $1 million.

9. Grandparent Scams

Grandparent scammers target a very vulnerable crowd: seniors. The fraudster pretends to be the grandchild seeking financial help or sometimes poses as a cop holding the child for a crime and requiring bail for release.

The pandemic has made it easier to fool senior citizens, with requests like “in hospital with COVID grandpa. Need $10,000 ASAP for hospital fees.” It’s no surprise that grandparent scams are on the rise during this time.

Quite recently, a victim in Florida lost over $700,000 in a grandparent scam. The scammers persuaded the victim that her granddaughter required legal assistance and instructed her to make withdrawals from her bank. She then handed the money over to a courier, which is in line with the tactics of these scammers.

What to Look Out For

The person posing as your grandchild or family member will try to pressure you for immediate payment and provide details of how to send that money. The call usually comes late at night as scammers feel seniors are more easily confused or disoriented at that time.

The best thing to do is hang up immediately and directly reach out to the concerned family member. If the scammer is impersonating a police offer, get in touch with the authorities and verify the name of the officer. One grandma even set up a sting with the police to capture her would-be scammer.

All in all, never send out money without verifying the identity of the recipient and whether the situation is a reality or has been fabricated to fool you.

10. Internal Revenue Service Scams

We all know the importance of paying taxes and following the laws. So do the scammers, and some of them tap into your lawfulness as a citizen to get some extra money out of you.

These scammers might pose as agents of the Internal Revenue Service (IRS) and claim you need to send money as part of your tax obligations. They might threaten you to pay up that money, saying you’ll face some serious consequences if the payment is not made within a certain period.

According to the IRS, thousands of people are targeted by these scammers and give up both their private information and money. This scam is often done via email account communications, telephone or text. The scammer will usually press the victim for an electronic funds transfer or specify the payment method in detail.

Most of these scammers impersonate federal officers, which is a crime in and of itself. For example, in a recent IRS phone scam, an Indian scammer working out of a call center targeted and scammed millions of tax dollars out of U.S. nationals with his co-conspirators.

What to Look Out For

Keep in mind that the actual IRS would never request sensitive information or payments from taxpayers by email, SMS or social media. If you are on the receiving end of such a communication, do not divulge any kind of information to them.

How to Report Internet Scams

It’s your duty to submit scam reports, whether you were a victim of a scam and suffered a loss or merely reporting an attempted scam. Here are some websites and resources to consider when you report a scam.

- First, report the scam to your local police branch and then the state consumer protection office.

- You can also raise the issue with the relevant federal government agency.

- Report disaster and relief-related scams to the National Center for Disaster Fraud through this online form.

- The Federal Trade Commission collects most scam reports. You can report the fraud on the FTC fraud report page.

- Report IRS-related scams or imposters to the Treasury Inspector General for Tax Administration.

- Report international scams and crimes to the Internet Crime Complaint Center (IC3) on their website and to econsumer.gov.

Protect Yourself From Internet Scams

It’s the age of digital transformation and crime, guys. The internet is a scary place, and the best thing you can do to protect yourself is be informed and well aware of the most common scams you might face.

It’s also important to follow your gut and apply common sense. If something feels off to you, it probably is. Act on your gut and use your instincts if you feel you’ve got a scammer on your hands.

Have you encountered a scam online? How did you tackle the situation? Let me know in the comments! As always, thanks for reading, everyone!

Leave a Reply